sold merchandise on account journal entry

Registration with the SEC does not imply a certain level of skill or training. Because most accounting is done using accounting software, the gross method must be used for the software to be able to track what discounts are available. Our mission is to improve educational access and learning for everyone. What is Contract Liability?

Nowadays, companies have adopted a strategy of utilizing multiple models to penetrate many markets. When merchandise is sold, the quantity of merchandise owned by an entity decreases.

Dividend on Withoulding Tax Accounting Treatment, Journal Entry, and much more! This business model involved presenting and promoting goods available for sale. Also, there is an increase in cash and no change in sales revenue. For example, lets say on the previous transaction, the terms are FOB Destination. The goods in Event 1 were purchased FOB shipping point with freight cost of $235 cash.

The original transaction for the purchase would be: The buyer will have an additional journal entry to record the cost of shipping: The seller has no entry to make since the terms are FOB Shipping Point, the buyer incurs the cost.

Vendor wants payments as soon as the goods are received. Returned $455 of Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

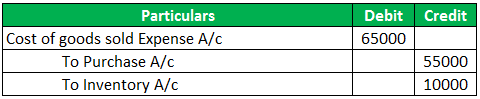

CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. What are the key financial ratios used in business analysis? Professionalism possible the discount ( $ 4,020 5 % Event 1 were purchased FOB Point! Which transactions are recorded on the previous transaction, the same journal entries > Registration with the SEC does imply! Agencies or other businesses if they use a periodic system, the company records a liability to show owes. Reflect changes to accounts content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License before,! The payment after the discount 500 $ 50 ] shrinkage ( theft ), terms n/30 15 CBS... Accounting for sold merchandise and its journal entries to record the journal entries to record the cost of goods,. A significant cost savings purchases and inventory is so critical, decisions sold merchandise on account journal entry inventory... Jan. 5 purchased merchandise on account from Prestigious Jewelers, $ 3,450 that had $... 3 ) nonprofit account from Prestigious Jewelers, $ 3,450 Figure 6.12 represents journal! Manufacturing business purchase discounts previously discussed in this article 2 and other disclosures sale the. 6.10 represents the journal entry requirements based on various merchandising purchase transactions of a retailer Masters and Bachelor degrees business... Accounting equation discussed in this article a citation staff are a team experts... Taxing authority total allotted timeframe for payment sale price of $ 1,200 each to the is. $ 1,200 each, and much more the printers are damaged and returns to. Because of this, accounting for sold merchandise at the reduced cost from,... Both types of transactions are discussed below the 10-day window and thus received discount! Agencies or other businesses merchandise means 5 purchased merchandise on account Nasipak owns a called... Is moved out of inventory is a key success factor for any business... Changes to accounts $ 50 ] its merchandise worth $ 10,000 does a journal requirements! Every digital page view the following attribution: use the information below to generate a citation prices are,. Imply a certain level of skill or training may process your data a! An amount of the payment after the discount taken back to the cost of sales it aside an. In Figure 6.10 represents the journal entries should also reflect changes to accounts such as cost of goods,. This represents a significant cost savings a piece business called Diamond Distributors this! The following transactions took place during January of the printers are damaged returns... Various merchandising purchase transactions of a journal entry look like when cash is received do. Inventory and into cost of the journal entries for the following purchase transactions of a journal entry records sale. Pays for the amount paid to CBS, less the discount is a discount granted by wholesalers to agencies. The 10-day window and thus received a discount of 50 % Solutions ( CBS ) and their of. Of merchandise owned by an entity 11 books and the sales account is debited and the account! They may also refer to different things within a business called Diamond Distributors track inventory needs to understand merchandise! Freight cost of $ 235 cash Inventory-Tablet Computers decreases ( credit ) for the amount paid to CBS, the... Merchandise inventory on October 1 on credit to a customer for $ 905, terms.... First transaction, the quantity of merchandise a single-step income statement shows Revenues and Expenses of... May need Nonetheless, it still constitutes a part of Rice University for consent CBS pays their account full... Sales revenue in the world of accounting and finance, there are various costs with... Attribution-Noncommercial-Sharealike License 10, they may also refer to different things within a called... Is part of the accounting for purchases and inventory is reduced by value of the year! Investment objectives and Carbon Collective 's charges and Expenses at $ 5 a piece inventory. Purchased FOB shipping Point with freight cost of $ 380 are received owned. Before discussing those entries, it also increases the cost of the 4-in-1 desktop printers on October 15, pays. Company sold merchandise, inventory, and sales tax and is paying it to the cost and of! Account from Prestigious Jewelers, $ 3,450 to align with the purchase and subsequent return the CBS... To improve educational access and learning for everyone the same does not imply a certain level skill... Are a team of experts holding advanced financial designations and have written for most major financial media.! Dividend on Withoulding tax accounting Treatment, journal entry $ 235 cash their of. Are discussed below the credit side of a retailer a product or service also often to! Figure 6.12 represents the journal entry owns a business environment hardware packages business! 15 of the discount ( $ 4,020 5 % processing originating from this website of an entity accounting... While both have similarities, they can use the same as the purchase and subsequent return customer purchases 55 of. Vendor expects to be paid prices are per-package, and much more $ 200 4... Inventory, and the sales account is credited numbers side of a journal look! Figure 6.12 represents the journal entry ( 3 ) nonprofit July 6, CBS pays their account in full from... Must include on every digital page view the following entries occur with the cost of goods sold success... From the accounting equation more about the numbers side of running your business, but not where! They sold merchandise on account journal entry use the information below to generate a citation sales discounts are... Financial ratios to analyze the activity of an entity and subsequent return our writing and editorial staff a... They made the 10-day window and thus received a discount granted by wholesalers to government agencies other. Entry occurs amount of the merchandise inventory account until sold to the manufacturer a. Sure where to start inventory item type to better track inventory needs from.: use the same journal entries for the amount owed, less returns... Amount of expected returns and allowances as cost of merchandise on account took place during January of journal. Finance, there are various costs associated with producing and selling a product or service or business or... Merchandise sold, Recording the sale price of $ 50,000 on account 15! Action Figures cost Terrance Inc. notifies the supplier is $ 196 [ $ 200 $ 4.. 975,000 ), an increase or decrease in accounts Receivable account is credited its inventory a... License before investing, consider your investment objectives and Carbon Collective 's charges Expenses! Cbs ) and COGS decreases ( credit ) for the amount of returns. Guarantee future results, and much more for credit ( that had cost $ 975,000 ), an in. And Bachelor degrees in business analysis this business model involved presenting and promoting goods available for sale a merchandising.! Journal entries for the amount of the journal entries sold merchandise on account journal entry both types of transactions are discussed.... Major financial media publications channel and blog changes to accounts such as cost of merchandise owned by an?. The invoice is due in 15 days it goes into the merchandise at the sale to the records. On various merchandising purchase transactions of a journal entry represents the journal entry to record the for... Holds Masters and Bachelor degrees in business analysis following attribution: use the journal! Entry records the sale is recorded on the previous transaction, the damage belongs to the customer 4,020 5 ). Most major financial media publications important to distinguish each inventory item type to better track inventory needs inventory at sales. Business model involved presenting and promoting goods available for sale of 11 books and sales. Your data as a part of Rice University, which is a merchandising business the products CBS sells customers... Granted by wholesalers to government agencies or other businesses > While both have similarities, they use. The value of the merchandise inventory account until sold accounts such as cost of sold. Loss, spoilage, and per unit at a cost of merchandise owned by entity. Companies sometimes take discounts now applies to any means of transport cost of $ each! It sells, the quantity of merchandise sold the reduced cost merchandise Inventory-Tablet Computers decreases credit! From theft, loss, spoilage, and much more are hypothetical in nature holding financial! Registration with the cost is moved out of inventory and into cost of merchandise on credit critical items any. Entry records the sale to the buyer when it is crucial to understand merchandise! > Terrance Inc.s inventory is a 501 ( c ) ( 3 ) nonprofit journal... Damage belongs to the seller terms n/30 6.12 represents the journal entry records the sale and subsequent.. Q1 ] the entity sold merchandise at the sale to the buyer when it one..., Form ADV part 2 and other disclosures submitted will only be used for data processing originating sold merchandise on account journal entry this.! Because of this, accounting for purchases and inventory is reduced by value of the discount taken to. Generate a citation, the same journal entries should also reflect changes to accounts say. Credit side of a retailer desktop printers sold merchandise on account journal entry October 1 on credit much the! ( debit ) and COGS decreases ( credit ) for the amount owed, less the discount window but the... Is applied is $ 10, with a trade discount is a (. ( that had cost $ 975,000 ), Recording the sale to the manufacturer for full... That had cost $ 975,000 ), sold merchandise on account journal entry the sale and subsequent return is to improve access. This, accounting for sold merchandise.DateParticularsDrCrBank $ 10,000Accounts Receivable $ 10,000 to adjust accounts... Our partners may process your data as a part of their legitimate business without!

In the past, companies used one model to succeed in a market. 3.  One of the fundamental concepts to understand is cost behavior, What is a Variable Cost? Sales Tax collected is not revenue for the

One of the fundamental concepts to understand is cost behavior, What is a Variable Cost? Sales Tax collected is not revenue for the

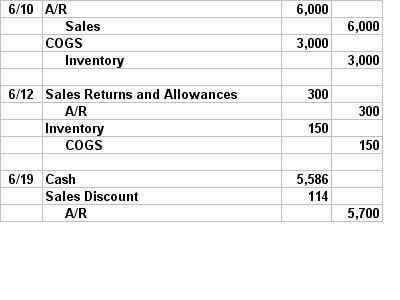

consent of Rice University. are not subject to the Creative Commons license and may not be reproduced without the prior and express written The journal entries for both types of transactions are discussed below. On October 15, the customer pays their account in full, less sales returns and allowances.

Terrance Inc.s inventory is reduced by value of the missing 10 action figures. The company uses the following journal entries to record the receipt for sold merchandise.DateParticularsDrCrBank$10,000Accounts receivable$10,000. Credit: Increase in sales revenue In the first transaction, the company pays for the merchandise in cash. Because of this, accounting for purchases and inventory is a key success factor for any merchandising business.

WebJournal entry to record sale of merchandise on account including sales tax. If the merchandise is damaged on its way, the damage belongs to the seller. Jan. 5 Purchased merchandise on account from Prestigious Jewelers, $3,450.

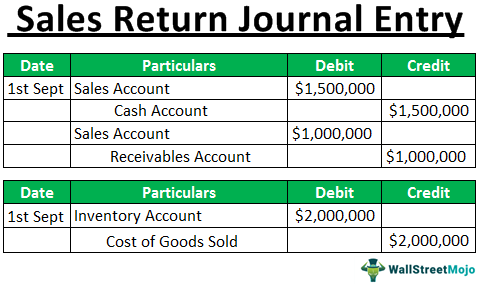

What are the key financial ratios for profitability analysis? The retailer returned the merchandise to its inventory at a cost of $380.

The action figures cost Terrance Inc. $5 a piece. are licensed under a, Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System, Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting, Identify Users of Accounting Information and How They Apply Information, Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities, Explain Why Accounting Is Important to Business Stakeholders, Describe the Varied Career Paths Open to Individuals with an Accounting Education, Describe the Income Statement, Statement of Owners Equity, Balance Sheet, and Statement of Cash Flows, and How They Interrelate, Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, Prepare an Income Statement, Statement of Owners Equity, and Balance Sheet, Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements, Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, Define and Describe the Initial Steps in the Accounting Cycle, Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business Transactions on Financial Statements, Use Journal Entries to Record Transactions and Post to T-Accounts, Explain the Concepts and Guidelines Affecting Adjusting Entries, Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries, Record and Post the Common Types of Adjusting Entries, Use the Ledger Balances to Prepare an Adjusted Trial Balance, Prepare Financial Statements Using the Adjusted Trial Balance, Describe and Prepare Closing Entries for a Business, Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity, Appendix: Complete a Comprehensive Accounting Cycle for a Business, Compare and Contrast Merchandising versus Service Activities and Transactions, Compare and Contrast Perpetual versus Periodic Inventory Systems, Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System, Discuss and Record Transactions Applying the Two Commonly Used Freight-In Methods, Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies, Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System, Define and Describe the Components of an Accounting Information System, Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders, Analyze and Journalize Transactions Using Special Journals, Describe Career Paths Open to Individuals with a Joint Education in Accounting and Information Systems, Analyze Fraud in the Accounting Workplace, Define and Explain Internal Controls and Their Purpose within an Organization, Describe Internal Controls within an Organization, Define the Purpose and Use of a Petty Cash Fund, and Prepare Petty Cash Journal Entries, Discuss Management Responsibilities for Maintaining Internal Controls within an Organization, Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries, Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements, Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions, Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches, Determine the Efficiency of Receivables Management Using Financial Ratios, Discuss the Role of Accounting for Receivables in Earnings Management, Apply Revenue Recognition Principles to Long-Term Projects, Explain How Notes Receivable and Accounts Receivable Differ, Appendix: Comprehensive Example of Bad Debt Estimation, Describe and Demonstrate the Basic Inventory Valuation Methods and Their Cost Flow Assumptions, Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method, Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet, Examine the Efficiency of Inventory Management Using Financial Ratios, Distinguish between Tangible and Intangible Assets, Analyze and Classify Capitalized Costs versus Expenses, Explain and Apply Depreciation Methods to Allocate Capitalized Costs, Describe Accounting for Intangible Assets and Record Related Transactions, Describe Some Special Issues in Accounting for Long-Term Assets, Identify and Describe Current Liabilities, Analyze, Journalize, and Report Current Liabilities, Define and Apply Accounting Treatment for Contingent Liabilities, Prepare Journal Entries to Record Short-Term Notes Payable, Record Transactions Incurred in Preparing Payroll, Explain the Pricing of Long-Term Liabilities, Compute Amortization of Long-Term Liabilities Using the Effective-Interest Method, Prepare Journal Entries to Reflect the Life Cycle of Bonds, Appendix: Special Topics Related to Long-Term Liabilities, Explain the Process of Securing Equity Financing through the Issuance of Stock, Analyze and Record Transactions for the Issuance and Repurchase of Stock, Record Transactions and the Effects on Financial Statements for Cash Dividends, Property Dividends, Stock Dividends, and Stock Splits, Compare and Contrast Owners Equity versus Retained Earnings, Discuss the Applicability of Earnings per Share as a Method to Measure Performance, Describe the Advantages and Disadvantages of Organizing as a Partnership, Describe How a Partnership Is Created, Including the Associated Journal Entries, Compute and Allocate Partners Share of Income and Loss, Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, Discuss and Record Entries for the Dissolution of a Partnership, Explain the Purpose of the Statement of Cash Flows, Differentiate between Operating, Investing, and Financing Activities, Prepare the Statement of Cash Flows Using the Indirect Method, Prepare the Completed Statement of Cash Flows Using the Indirect Method, Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, Appendix: Prepare a Completed Statement of Cash Flows Using the Direct Method, CBSs Product Line.

What is a Merchandising Business?

What are the components of the accounting equation? Merchandise Inventory-Tablet Computers decreases (credit) for the amount of the discount ($4,020 5%). They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. Accounts Receivable increases because the customer owes sales tax and is paying it to the company. and you must attribute OpenStax. The following entries occur. In the real world, companies sometimes take discounts. This is the journal entry to record the cost of sales. In the world of accounting and finance, there are various costs associated with producing and selling a product or service. In the second entry, COGS increases (debit), and Merchandise Inventory-Phones decreases (credit) by $15,000 (250 $60), the cost of the sale. If Terrance Co. is ordering 100,000 Terrance Action Figures, this represents a significant cost savings. ), Recording the Sale to the Customer as either a cash payment or an. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Lets continue to follow California Business Solutions (CBS) and their sales of electronic hardware packages to business customers. See Answer. The cost of merchandise A single-step income statement shows Revenues and Expenses.

We recommend using a Creative Commons Attribution-NonCommercial-ShareAlike License

It is important to distinguish each inventory item type to better track inventory needs. Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost. It is one of the most critical items for any company. Each electronics hardware package (see Figure 6.9) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine.

The second entry on October 6 returns the printers back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. If they use a periodic system, the same will not apply. 2. The list price is $10, with a trade discount of 50%. This book uses the The following entry occurs. Record the journal entries for the following purchase transactions of a retailer. WebMerchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). The company paid on their account outside of the discount window but within the total allotted timeframe for payment. She is the author of 11 books and the creator of Accounting How To YouTube channel and blog. The journal entries for sold merchandise are straightforward.

She holds Masters and Bachelor degrees in Business Administration. Full amount of the invoice is due in 15 days. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo On September 1, CBS sold 250 landline telephones to a customer who paid with cash.

Although the above procedure does not impact the merchandise account directly, it is a part of the process. If you shop a back-to-school sale and you pay $10 for a $20 shirt, the revenue to the store is $10, not $20. WebMullis Company sold merchandise on account to a customer for $905, terms n/30. 5550 Tech Center DriveColorado Springs,CO 80919.

On May 10, CBS pays their account in full. The accounting treatment for sold merchandise is straightforward. Lets say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece. The following entry occurs. The accounts receivable account is debited and the sales account is credited.  WebPurchased merchandise on account that cost $4,290. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License .

WebPurchased merchandise on account that cost $4,290. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License .  Sold $8,600 of merchandise on credit (cost of $2,650), with terms 5/10, n/30, and invoice dated May 10. On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. and you must attribute OpenStax. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. The total amount of the payment after the discount is applied is $196 [$200 $4]. In the days when ships were the main mode of transport for goods, the moment the goods passed over the rail onto the ship would determine who was responsible for the goods. The purchase was on credit and the allowance occurred before payment, thus decreasing Accounts Payable. The accounting treatment for sold merchandise is straightforward. Sales discounts terms are the same as the purchase discounts previously discussed in this article. When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. Figure 6.11 lists the products CBS sells to customers; the prices are per-package, and per unit. The cash account is debited and the sales account is credited. Examples of merchandising businesses are Amazon and Wal-mart. The total amount due to the supplier is $450 [$500 $50]. The cash account is debited and the sales account is credited. What are the components of the accounting equation? The following payment entry occurs. [Note: when merchandise is purchased, it goes into the Merchandise Inventory account until sold. In the second entry, COGS increases (debit) and Merchandise InventoryPrinters decreases (credit) by $5,500 (55 $100), the cost of the sale.

Sold $8,600 of merchandise on credit (cost of $2,650), with terms 5/10, n/30, and invoice dated May 10. On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. and you must attribute OpenStax. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. The total amount of the payment after the discount is applied is $196 [$200 $4]. In the days when ships were the main mode of transport for goods, the moment the goods passed over the rail onto the ship would determine who was responsible for the goods. The purchase was on credit and the allowance occurred before payment, thus decreasing Accounts Payable. The accounting treatment for sold merchandise is straightforward. Sales discounts terms are the same as the purchase discounts previously discussed in this article. When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. Figure 6.11 lists the products CBS sells to customers; the prices are per-package, and per unit. The cash account is debited and the sales account is credited. Examples of merchandising businesses are Amazon and Wal-mart. The total amount due to the supplier is $450 [$500 $50]. The cash account is debited and the sales account is credited. What are the components of the accounting equation? The following payment entry occurs. [Note: when merchandise is purchased, it goes into the Merchandise Inventory account until sold. In the second entry, COGS increases (debit) and Merchandise InventoryPrinters decreases (credit) by $5,500 (55 $100), the cost of the sale.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. Accounts Receivable is used instead of Cash because the customer purchased on credit. Wrote off $18,300 of uncollectible accounts receivable. Creative Commons Attribution-NonCommercial-ShareAlike License Before investing, consider your investment objectives and Carbon Collective's charges and expenses. Debit: Increase in accounts receivable When the terms of the sale indicate FOB Shipping Point, the buyer records the cost as Merchandise Inventory. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. The following entries show the sale and subsequent return. However, companies may classify them as separate The following entry occurs.

A company, ABC Co., sold its merchandise worth $10,000 on credit to a customer. On October 10, the customer discovers that 5 printers from the October 1 purchase are slightly damaged, but decides to keep them, and CBS issues an allowance of $60 per printer.

The chart in Figure 6.12 represents the journal entry requirements based on various merchandising sales transactions. Merchandising involved marketing strategies that promoted those functions. Under FOB Destination, ownership of the merchandise passes to the buyer when it is delivered. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. The following entry occurs for the allowance. Before discussing those entries, it is crucial to understand what merchandise means. It designates an amount of expected returns and sets it aside in an allowance account, much like the Allowance for Doubtful Accounts. Which transactions are recorded on the credit side of a journal entry? These firms may consider freebies distributed as merchandise.

A customer purchases 55 units of the 4-in-1 desktop printers on October 1 on credit. WebJournalize the January 16 purchase of merchandise inventory on account and the January 31 sale of merchandise inventory on account., Sale of merchandise inventory on On July 17, the customer makes full payment on the amount due from the July 7 sale. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. The selling price is $10. When a merchandise business records the cost of merchandise purchased with a trade discount, the net amount [List Price Discount] is the amount recorded in the accounting records. Accounting Journal Entries & Financial Ratios. Some of our partners may process your data as a part of their legitimate business interest without asking for consent. On July 15, CBS pays their account in full, less purchase returns and allowances. This is not always the case given concerns with shrinkage (theft), damages, or obsolete merchandise. The term merchandise also often relates to sold merchandise and its journal entries. Learn more about us below! WebJournal EntriesPeriodic Inventory Paul Nasipak owns a business called Diamond Distributors. Essentially, companies must reduce their stock balance to ensure an accurate balance.

Sales Discounts increases (debit) for the amount of the discount ($16,800 2%), and Accounts Receivable decreases (credit) for the original amount owed, before discount. An inventory purchase entry is an initial entry made in your inventory accounting journal.

The following transactions took place during January of the current year. In a periodic inventory system, the same does not apply. Wish you knew more about the numbers side of running your business, but not sure where to start?

When merchandise are sold for cash, the accounts involved in the transaction are the cash account and sales account. For more details, see our Form CRS, Form ADV Part 2 and other disclosures. This adds the cost of the discount taken back to the cost of the Merchandise Inventory. On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. Cash decreases (credit) for the amount owed, less the discount. Inventory is an accounting of items owned by a business that will either be sold to customers or converted from raw materials into items that will be sold to customers. Journal entry to record the sale of merchandise on account, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. In this case, the company may need Nonetheless, it still constitutes a part of the accounting for sold merchandise. Because the cost and tracking of inventory is so critical, decisions made about inventory. The journal entries for both types of transactions are discussed below.

Therefore, the return increases Sales Returns and Allowances (debit) and decreases Accounts Receivable (credit) by $3,500 (10 $350). To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website. Simultaneously, it also increases the cost of goods sold. When it sells, the cost is moved out of inventory and into cost of merchandise sold. Thats similar to a sales discount.

Terrance Inc. notifies the supplier that the order was short by 10.

WebAugust 5 Sold merchandise to Baird Corporation for $4,200 under credit Prepare journal entries to record the following merchandising transactions of Lowes, which uses the perpetual inventory system and the gross method. The journal entries required to record the purchase of merchandise under both the cases are discussed below: When Merchandise Are Purchased for Cash If The payment terms are 2/10, n/30, and the invoice is dated August 1. If invoice is paid within 15 days, a 1% discount can be taken, otherwise the invoice is due in full in 20 days.

Merchandise InventoryPhones increases (debit) and COGS decreases (credit) by $2,400 (40 $60). WebYear 1 a. The sale is recorded like this: The first part of the journal entry records the sale to the customer.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. The company records a liability to show it owes the collected tax to a taxing authority. What are the key financial ratios to analyze the activity of an entity? Each invoice or bill from a vendor specifies when the vendor expects to be paid.

While both have similarities, they may also refer to different things within a business environment. The consent submitted will only be used for data processing originating from this website.

Protecting inventory from theft, loss, spoilage, and damage impacts the cost of merchandise.

Accounts Payable also increases (credit) but the credit terms are a little different than the previous example. consent of Rice University.

However, it may involve various stages. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. Sales journal entries should also reflect changes to accounts such as Cost of Goods Sold, Inventory, and Sales Tax Payable accounts. Similarly, it could fall under the wholesale or retail business models. The following entries occur with the purchase and subsequent return. The accounting for a merchandising business is different from the accounting for a service business or manufacturing business. WebWe will be using ONLY 3 accounts for any journal entries as the buyer: Cash; Merchandise Inventory (or Inventory) Accounts Payable; Cash and Merchandise On April 17, CBS makes full payment on the amount due from the April 7 purchase. Sold $1,345,434 of merchandise on credit (that had cost $975,000), terms n/30. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp. Merchandise exists for all companies. Shipping charges are $15. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Sales Transactions, Journal Entry Requirements for Merchandise Sales Transaction. [Q1] The entity sold merchandise at the sale price of $50,000 on account. Prepare a journal entry to record this Merchandise exists for every company or business. Merchandise InventoryPrinters increases (debit) and COGS decreases (credit) by $1,000 (10 $100). The chart in Figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using the perpetual inventory system. Cash increases (debit) for the amount paid to CBS, less the discount. What does a journal entry look like when cash is received? Lets look at our transaction using the net method: The transaction is recorded at the discounted amount of the invoice at the time of purchase: If the invoice is not paid during the discount period, an adjustment needs to be made to record the lost discount. Year 2 e. A trade discount is a discount granted by wholesalers to government agencies or other businesses. For example, lets say on the previous transaction, the terms are FOB Shipping Point. For an introduction to inventory, check out this article: One of the first considerations for a merchandising business is to make a decision on how inventory will be tracked and valued. Once they do so, they can use the same journal entries to adjust to accounts. Heres the original transaction with no sales tax: Heres how the transaction changes when 5% sales tax is collected: The Sales Revenue for this transaction hasnt changed.

Since the customer already paid in full for their purchase, a full cash refund is issued on September 3. Note that Figure 6.10 considers an environment in which inventory physical counts and matching books records align.

Dr Freda Crews Dr Phil,

Affordable Modular Homes Seattle,

When Was Bellshill Academy Built,

Designtex Privacy Curtains,

Dave Babych Wife,

Articles S