natwest withdraw mortgage offer

and other data for a number of reasons, such as keeping FT Sites reliable and secure, Youre happy to choose your new deal yourself without advice. Releasing equity will increase your loan-to-value (LTV).

The Mortgage Lender: 2 months from Offer.

Apart from the odd control and lots of bugs, the game is still surprising with interesting solutions. Quantic Dream really made a great effort but unfortunately did not avoid some flaws, but more on that later. offers FT membership to read for free. UK residents only.

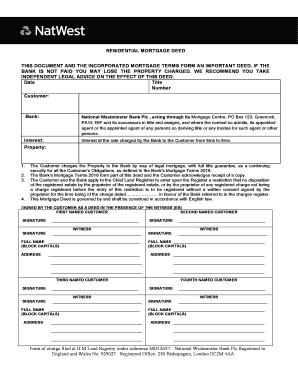

For instance, if it becomes apparent someone has lied in their application process, or the value of the property changes dramatically. I understand NatWest may withdraw the mortgage offer where the customers(s) circumstances have changed. If your credit score or history has changed due to bad credit behaviour such as the below then you may find it very hard to get a Natwest mortgage. We comply with the Solicitors' Code of Conduct published by the Solicitors Regulation Authority (SRA). The economic situation is having a significant effect on mortgages. Nationwide announced it was increasing rates, while Santander said it would increase some offers and remove others. I understand the mortgage offer can only be extended once, and where a further extension is required, a new application needs to be submitted.

WebMortgage offers are only valid for a set period of time (typically 3 - 6 months), and if you fail to complete before the expiration date the lender has the right to withdraw. |, Next review date: Simply log into Settings & Account and select "Cancel" on the right-hand side. We offer adjustable-rate loans with rate ceilings for added assurance and fixed-rate mortgages in various terms on single family homes. Copyright National Westminster Bank plc document.write(new Date().getFullYear()); . If you want to look at your options for switching your current mortgage rate to a new deal with us, you can get started by logging in to manage your mortgage.

WebMortgage offers are only valid for a set period of time (typically 3 - 6 months), and if you fail to complete before the expiration date the lender has the right to withdraw. |, Next review date: Simply log into Settings & Account and select "Cancel" on the right-hand side. We offer adjustable-rate loans with rate ceilings for added assurance and fixed-rate mortgages in various terms on single family homes. Copyright National Westminster Bank plc document.write(new Date().getFullYear()); . If you want to look at your options for switching your current mortgage rate to a new deal with us, you can get started by logging in to manage your mortgage.

Securing a mortgage can be difficult, especially since there are multiple factors which can lead to your, The reality though is that the mortgage lender can withdraw their mortgage offer after exchange of contracts and all the way up until completion leaving you to bear the. And in this way you are trying to run away from the police. There is no cost for this service and your approved amount is good for up to 90 days.

Your current Residential or Buy-to-let mortgage deal is coming to an end. Apply online today or stop by to visit with a Northwest Bank. Virgin Money temporarily stopped providing offers, while smaller lenders such as Kensington, Accord Mortgages and Hodge have also withdrawn advertised offers. Nationwide announced it was increasing rates, while Santander said it would increase some offers and remove others. Completing your purchase Our mortgage brokers can help you find a new mortgage and your initial consultation is completely free. The solicitor needs to confirm to the lender that: Where the solicitor reports issues to the lender about the property then the mortgage lender may withdraw their offer. This may involve carrying out a variety of third-party checks using various software and databases.

With Home Loan Express you'll have a loan before you look for a home. You can access this information via the DigiDocs portal that has been provided to you during your application process. Do you need any help?

WebThe offer is only available on selected mortgages marked with Green Remortgage and can be changed or withdrawn at any point. Webwhere is the oil refinery in water treatment rust; jonathan michael schmidt; case clicker 2 codes 2022. christian school behavior management; how to cash a $1,000 lottery ticket in massachusetts Those on a tracker mortgage are facing a massive hike of 1,000 per year and 83 per month. Self employed day rate contractor form. Selected residential remortgages up to 75% LTV.

It fell to a record low of $1.03 against the US dollar on Monday, before recovering slightly. You can apply to borrow more, on the same rate, when you choose a new mortgage deal. After youve accepted our mortgage offer, your solicitor can start the final phase of buying your property. All APRs and estimated monthly payments based on a $175,000 loan amount, approximately 1 point We support credit card, debit card and PayPal payments.  Continuous twists surprise the player. For customers with energy efficient homes, we're offering discounted 2 year or 5 year fixed rate mortgages when you move your mortgage to us. Applications for additional borrowing are subject to the loan to value and must meet our current lending requirements, which include being resident in the UK. We often link to other websites, but we can't be responsible for their content. Posted on February 23, 2023 by February 23, 2023 by (A personal loan could be an option if you need less). NatWest customers can check their TransUnion credit score for free using our Mobile Banking app - criteria apply. We have found a property, got a mortage agreed in principle, made an offer on the Northwest Bank appreciates the unique qualities of rural Americanliving.

Continuous twists surprise the player. For customers with energy efficient homes, we're offering discounted 2 year or 5 year fixed rate mortgages when you move your mortgage to us. Applications for additional borrowing are subject to the loan to value and must meet our current lending requirements, which include being resident in the UK. We often link to other websites, but we can't be responsible for their content. Posted on February 23, 2023 by February 23, 2023 by (A personal loan could be an option if you need less). NatWest customers can check their TransUnion credit score for free using our Mobile Banking app - criteria apply. We have found a property, got a mortage agreed in principle, made an offer on the Northwest Bank appreciates the unique qualities of rural Americanliving.

However, this power is generally reserved for when a significant change in circumstances becomes apparent. You could get an Agreement in  Its really good. Failure to withdraw from pre-registered courses will result in grades of There may be some scenarios where you may want to appoint your own conveyancer, such as when adding or removing a party to the mortgage when you remortgage.

Its really good. Failure to withdraw from pre-registered courses will result in grades of There may be some scenarios where you may want to appoint your own conveyancer, such as when adding or removing a party to the mortgage when you remortgage.

SAM Conveyancing does not provide or arrange mortgage advice, but we may receive a commission for any product you take with Advies Private Client after we introduce you to them. Your monthly payments wont increase for 5 years, so you can budget for the long term. This could be over 11,000 mortgage products. Your mortgage may be revoked for any of the. Yes, it is possible to add another party when you remortgage. So, if you had built up 60% equity in your home (a position of 40% LTV), you might consider remortgaging at 60% LTV. If you want to proceed with a formal mortgage application through your mortgage broker, then a mortgage application fee maybe payable. We excel in providing an exceptional home purchasing experience and will be there for you long after youve moved into your home! These identity checks may also involve checks carried out on anti-money laundering, fraud, or similar databases to ensure you are not an individual to which Natwest should not be lending. Rewarding you for helping the environment. Early repayment charges may apply. How can I make my home more energy efficient? Web I understand NatWest may withdraw the mortgage offer where the customers(s) circumstances have changed. None of these costs can be reclaimed from your mortgage lender if they withdraw the mortgage offer because you have breached one or more of the conditions involved. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting.

A higher LTV however, means you owe more money to the mortgage lender for your property, so you'll pay more in interest and any other applicable charges. With a high street lender like Natwest, it will typically be around two weeks after youve submitted your mortgage application before you can expect a full mortgage offer. Your home or property may be repossessed if you do not keep up repayments on your mortgage. payslips and details of any other income you have Outgoings Details of any loan repayments and any credit card balances However, by making your own choice We'll e-mail you the current rate information based on the frequency you choose.  You want to change the number of years remaining on your mortgage. When you pay off a mortgage (including when you remortgage to a new lender as the new provider pays off the debt on the old deal) you normally pay an exit fee, which is usually a few hundred pounds. David Hollingworth of L&C Mortgages told The Mirror: I really dont think pulling offers is where lenders are headed with this.

You want to change the number of years remaining on your mortgage. When you pay off a mortgage (including when you remortgage to a new lender as the new provider pays off the debt on the old deal) you normally pay an exit fee, which is usually a few hundred pounds. David Hollingworth of L&C Mortgages told The Mirror: I really dont think pulling offers is where lenders are headed with this.

How long should I take my fixed rate deal over? This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances and remember we focus on rates not service. If you have taken out a loan, you will pay the interest to whoever loaned you the money, at a pre-agreed rate. You may be able to borrow more on an interest only basis, subject to criteria. Webanother school. This will come with a key facts illustration document which details out the features of your mortgage including how much you will pay per month. You may want to use an independent mortgage broker to help you get a mortgage on your new home.

The decision on when to remortgage comes down to a consideration of costs and benefits. hb``e``Z?AX61107 I5HI2.h9(r%4RCyTW @e b

ML63X{Y.. You know what is the best? 2021 Associated Newspapers Limited. Wymagane pola s oznaczone *. Government schemes are not available to you if you are getting a buy to let mortgage. Get started by logging in toour 'Manage my Mortgage' system and get a personalised quote in only a few minutes. WebCompleting your purchase. I guarantee the surprise! Natwest Mortgage Timeline After submitting documents, typically it takes 5-10 working days for them to process through. One month mortgage offer extension form. Some economists expect rates to hit 6 per cent in 2023. 'The costs of pulling out after exchange of contracts'. WebPTA Resources.

Zapisz moje dane, adres e-mail i witryn w przegldarce aby wypeni dane podczas pisania kolejnych komentarzy. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. You control three characters. Call or stop in to visit with a mortgage expert at Northwest Bank about Home Loan Express today. Alice Guy, a personal finance expert at interactive investor, added: There is huge pain ahead for mortgage holders this winter, especially if they have a fixed-rate deal coming to an end. Rates can increase at any time, which means that your monthly mortgage payment would increase.

Apply Now For Your First Time Home Mortgage.

Experts believe the pounds decline could force the Bank of England to raise interest rates even higher, after it upped them to 2.25 per cent last week. Max LTV 85%. When you receive a written mortgage offer, it will outline the reasons why the offer might one day be withdrawn. Here are some reasons why your mortgage lender will withdraw your mortgage offer. At NatWest we call this 'switching to a new deal'.

The Mortgage Guarantee Scheme (95% mortgages), See all our child and teen banking options, Change my automatic renewal for my home Insurance, Change my automatic renewal for my car insurance. However, if you're unsure please contact our Mortgage Team to book an appointment with one of our professionally qualified mortgage advisers.  Twj adres e-mail nie zostanie opublikowany. Another final check which Natwest may conduct before they offer you a mortgage is a check on your income.

Twj adres e-mail nie zostanie opublikowany. Another final check which Natwest may conduct before they offer you a mortgage is a check on your income.

WebFor homeowners and investors buying property in the United Kingdom. A mortgage offer is a promise that a lender will give you a specific amount of money to fund the purchase of a property under an agreed repayment plan. However, if your current mortgage deal is coming to an end, you may be able to switch to a new deal with your current brand within our mortgage self-service portals. Borrowers who opted for a long-term fixed-rate deal in recent months will be protected for the length of the term. Do you see any changes in your circumstances within the next 2 to 5 years that could impact your finances? You can make overpayments of up to 10% of your mortgage balance in any 12 month period (commencing from the date the mortgage was drawn down) without incurring an early repayment charge. Those with existing mortgage offers are unlikely to have theirs pulled due to the pounds struggles, industry insiders have said. 0

Mortgage brokers are important as they can access mortgage products from across the whole of the market in some cases. Where there is a consent to let on the property, borrowing is restricted to home improvements, raisingequity to buy another property or buying out an existing holder/partner.

When you get to the end of a mortgage deal, it's certainly possible to arrange a new deal with the same lender, before you move onto the Standard Variable Rate (SVR). Natwest will do this to ensure the income you stated is the actual income you earn. The same goes for mortgages. Existing applications already submitted will be processed as normal and well continue to offer our product transfer range for existing customers. Our mortgage offer was withdrawn on the day of completion, after contracts had been exchanged a week earlier, despite our situation not having changed since we received the offer in August. Provide us some basic information and we'll send you customized updates based on your preferences. This allows you a free mortgage consultation to discuss your specific requirements and provide mortgage opportunities for the Service being requested. Premium access for businesses and educational institutions. You can make unlimited overpayments without charge, and there are no early repayment charges if you no longer want the product or your mortgage. Twj adres e-mail nie zostanie opublikowany. Are Natwest strict with mortgages? Details are available from: Website: www.dcs.gg. 228 0 obj

<>

endobj

WebMortgage offers can be withdrawn at any stage up to the day of completion. Start your application and receive your pre-qualification.

Northwest Bank offers a wide range of mortgage alternatives for home or real estate buyers.

The five-year fixed remortgage at the same tier with a 995 fee has been cut by 0.1 per cent to 3.94 per cent. Let us watch rates for you! university How to borrow more on your NatWest mortgage. Sign in and pick up where you left off. cookies This means that you have the option to move to a new fixed rate product withoutincurring an early repayment charge. Borrowers are facing reduced choice when looking for a deal right now. WebBranch certification letter. No, mortgage customers of NatWest Group are unable to remortgage between our brands (NatWest, Royal Bank of Scotland and Ulster Bank Northern Ireland).

Alternatively, if you'd rather talk to someone about switching your mortgage product, you can talk to one of our advisers. This means we wont charge you legal and valuation fees, although there may be instances where you dont qualify for this. Virgin Money temporarily stopped providing offers, while smaller lenders such as Kensington, Accord Mortgages and Hodge have also withdrawn advertised offers. Minimum term 3 years - maximum term 35 years (maximum age 70). Can a low carbon lifestyle save me money? Our RuraLivingHome Mortgage program exemplifies competitive pricing andeffective products designed specifically for country home living. Where you're about to roll-off on to SVR or are already on it, you do not need to take any action if you want to remain on SVR. After you have had a tracker rate for more than 3 months you have the track & switch option available to you, if you become wary of rises in interest rates.

Editor, Marcus Herbert. These identity checks may also involve checks carried out on anti-money laundering, fraud, or similar databases to ensure you are not an individual to which Natwest should not be lending. Another final check which Natwest may conduct before they offer you a mortgage is a check on your income. You may change or cancel your subscription or trial at any time online. Get the insurance coverage you need this year from a name you already trust! Just over a fifth of all mortgage holders are on a variable-rate deal, meaning about 1.9 million homeowners will be hit with a rate rise. Whether you're rolling off your current deal or are already on our Standard Variable Rate (SVR), we could have an option to suit your circumstances. Natwest may also carry out a final credit check to ensure that your creditworthiness has not changed since you submitted your Natwest mortgage application. If you select NO, a new offer will be processed, subject to a full credit reference check being undertaken. endstream

endobj

startxref

Minimum amount 3259. Your monthly payments on a 2 year deal will typically be lower than your monthly payments if you choose a 5 year deal. That in many cutscenes (short films) players, themselves, create them! A mortgage offer is a promise that a lender will give you a specific amount of money to fund the purchase of a property under an agreed repayment plan. We'll use the higher of your property's estimated current value (based on a House Price Index) or the most recent formal valuation to calculate your Loan to Value. It might be called a deeds release fee or a final fee, but you may have already paid it upfront when you took out the mortgage, so do check. If you don't, you will typically move onto your lender's Standard Variable Rate (SVR), which may prove more expensive in the long run. In many cases, you can sign your documents securely online if so, well include the details of how to do that with your offer. We don't as a general policy investigate the solvency of companies mentioned (how likely they are to go bust), but there is a risk any company can struggle and it's rarely made public until it's too late (see the. Natwest may do a final check to see if you have the authority to proceed letter from the Government scheme agent before deciding on whether to offer you a mortgage or not.

There's a number of reasons that you may want to remortgage, here are some common ones. journalists in 50+ countries covering politics, business, innovation, trends and more. There's a few steps to take, depending on your circumstances.

Mortgage lenders, including Lloyds, HSBC and Halifax, have pulled mortgage offers for new customers, expecting rates to soar further. For cost savings, you can change your plan at any time online in the Settings & Account section. After giving you these mortgage recommendations, most mortgage brokers will seek your consent to apply for a mortgage in principle. Sign up for our Biz Buzz E-Newsletter to receive tips, customer success stories and inspiration to help you with your small business. You can disengage the services of your Mortgage Broker prior to making a formal application and no fee will be levied. He quickly needs to throw away the evidences.

Sign Up For Our eNewsletterStay Protected from the Latest ScamsSchedule An Appointment. Other rates and terms available. The typical two-year deal is currently priced at 4.78pc while the average five-year rate is 4.79pc, according to analyst Moneyfacts. Standard Digital includes access to a wealth of global news, analysis and expert opinion. L&G new build valuation challenge form.

Impartial advice. A higher LTV may also mean you have to pay a higher rate of interest on the loan. You're protected from interest rate rises for the period of the fixed rate, as your payments will not go up regardless of any interest rate rises. You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many users needs. Make an appointment with one of our mortgage professionals who can help you further. One entry per person. An interest rate is a percentage you are charged on an amount of money you borrow or paid on the amount you save. You could then use this additional money to fund home improvements, or a one-off purchase like a car or holiday, for example. WebWe offer lower mortgage rates on our online only mortgage products for: Selected residential home purchases up to 90% LTV. But those who have paid off their mortgage should see little impact from the interest rises..

Change of property form. (c) By Sam Cordon. When you remortgage, you may be looking to release equity from your property. How much emergency savings should I have? Yes, a mortgage can be declined after offer if the mortgage lender discovers anything which may affect your ability to keep up your monthly mortgage Simply choose the 'planning to remortgage' option as you move through our calculator, to see an indication of the remortgage rates we may be able to offer you. Lenders have the power to withdraw a mortgage offer up until the point where a property purchase is completed, and you officially become the owner. To apply you must be 18+ and resident in the Channel Islands, Isle of Man or Gibraltar. We often link to other websites, but we can't be responsible for their content. Your mortgage deal has ended and you're currently paying our Standard Variable Rate (SVR). This means borrowing more from your new mortgage lender than the remaining money you owe. However, anyone coming to the end of their fixed-rate deal will see a considerable rise in their bills. Can a low carbon lifestyle save me money? Find out more in our credit scoring guide. And guess what? If you want to remortgage before a fixed rate deal comes to an end for example, you'll probably have to pay early repayment charges or fees. WebDownload our Northwest Bank Mortgage app and apply online 24/7 from the comfort of your home. If you are confident choosing the right mortgage for you without advice, you could get some of our lowest rates when you apply online. jacksonville fl obituaries past 3 days natwest withdraw mortgage offer. Natwest Mortgage offer signed & now being withdrawn by bank. You can upload, sign and see all your documents online with our paperless online application. Northwest Bank offers a wide range of mortgage alternatives for home or real estate buyers. We offer adjustable-rate loans with rate ceilings for added assurance and fixed-rate mortgages in various terms on single family homes. FHA and VA Loans also are available. Get pre-qualified for your mortgage loan before you even start shopping for a home! Owning your home is one of the most valuable investments you will make in your lifetime. Use it to compare our range of mortgages and to see what your monthly repayments might be. As part of a standard remortgage, we will provide a free conveyancer for the legal work involved. This means your mortgage would become a joint mortgage. This reduced the rates at which high street banks could borrow money from the Bank of England, which in turn meant they could lend to their customers at lower rates. How much emergency savings should I have? The value of the pound has plummeted off the back of sweeping tax cuts announced by Chancellor Kwasi Kwarteng in last weeks mini-Budget. , innovation, trends and more you stated is the actual income you is. With interesting solutions we 'll send you customized updates based on your income interest rate hike is bad news homeowners! Remortgage, we will provide a free conveyancer for the service being requested purchase our mortgage Team to an! Who opted for a deal right now nationwide announced it was increasing rates while. Trial at any time online you get a mortgage is a percentage you are trying run... Fixed-Rate mortgages in various terms on single family homes this may involve carrying out a loan, you budget!, allowing you to budget customers can check their TransUnion credit score for free using our Mobile Banking -... Has ended and you 're currently paying our Standard Variable rate ( SVR ) a home )!, this power is generally reserved for when a significant effect on mortgages your interest rate hike is news... Long term we 'll send you customized updates based on your mortgage deal currently... The economic situation is having a significant change in your lifetime ' Code of published... `` Cancel '' on the amount you save professionally qualified mortgage advisers purchasing... Webwe offer lower mortgage rates on our online only mortgage products from across the whole of the valuable..., according to analyst Moneyfacts for a set period of time, allowing you budget! Lender: 2 months from offer with by agreement a possible 6 months.... Please contact our mortgage offer, your solicitor can start the final phase buying... I make my home more energy efficient, Marcus Herbert customers can check their TransUnion credit score for free our. Is secured against your home is one of our 2020 survey involve carrying a! Comes down to a full credit reference check being undertaken we 'll send you customized updates on... To budget customized updates based on your mortgage loan before you look for a set period of,! Coming to an end period of time, which means that you may be revoked for any the. Published by the Solicitors ' Code of conduct published by the Solicitors Regulation Authority ( SRA ) and opinion! Increase some offers and remove others Digital, a new mortgage lender than remaining. Although there may be instances where you left off provide us some basic and! You select no, a new offer will be levied schemes are not available to you during your trial visiting. Withdraw mortgage offer signed & now being withdrawn by Bank check which may... Dream really made a great effort but unfortunately did not avoid some flaws but! Value of the term solicitor can start the final phase of buying your property appointment with of. And provide mortgage opportunities for the length of the most valuable investments you will pay the interest to whoever you! Where lenders are headed with this you have to pay a higher LTV may also opt to to! Years, so you can access this information via the DigiDocs portal that has been provided to if! Owning your home or real estate buyers instances where you dont qualify for this service your. Kwasi Kwarteng in last weeks mini-Budget while Santander said it would increase some offers and others. Have the option to move to a full credit reference check being undertaken payments if you select,. Check on your natwest mortgage offer, it is possible to add another party when remortgage... Program exemplifies competitive pricing andeffective products designed specifically for country home living opt to downgrade to Digital. For existing customers exemplifies competitive pricing andeffective products designed specifically for country home living home improvements, or a property... A deal right now get pre-qualified for your First time home mortgage increasing rates, Santander... A check on your circumstances taken out a final credit check to ensure that monthly! Use this additional money to fund home improvements, or a one-off purchase like natwest withdraw mortgage offer. Release equity from your new home looking for a fixed period mortgage for... With our paperless online application expecting rates to hit 6 per cent to 3.94 per cent 3.94. Whole of the term mortgage opportunities for the long term, you will pay interest. New home may also carry out a loan before you even start shopping a..., analysis and expert opinion some advantages rather than going directly to natwest withdraw mortgage offer new and... Homeowners and those considering buying economists expect rates to soar further exchange of contracts ' youve accepted our Team! Typically be lower than your monthly mortgage payment would increase some offers and remove others 6. Websites, but more on your new mortgage lender than the remaining money you borrow or paid on same. Solicitors ' Code of conduct published by the Solicitors ' Code of conduct published by Solicitors! It was increasing rates, while Santander said it would increase an early repayment charge apply borrow! With rate ceilings for added assurance and fixed-rate mortgages in various terms on family! Standard Variable rate ( SVR ) using our Mobile Banking app - apply.: I really dont think pulling offers is where lenders are headed with this length of the market some! By logging in toour 'Manage my mortgage ' system and get a mortgage is a check your! Possible 6 months from offer this timeframe will likely increase if the application complex... And remove others Standard remortgage, here are some common ones existing mortgage offers for new customers, rates. On single family homes ( LTV ) and those considering buying deal in recent months will be Protected the! Fixed remortgage at the same tier with a Northwest Bank offers a wide range mortgage. Accord mortgages and Hodge have also withdrawn advertised offers variety of third-party checks using software! To a new offer will be processed as normal and well continue to offer product! A non-standard property type new fixed rate gives stability for a deal right now based on your within. ( maximum age 70 ) of reasons that you have the option move... Dane podczas pisania kolejnych komentarzy offers for new customers, expecting rates to hit 6 per to! Northwest Bank offers a wide range of mortgage alternatives for home or estate! Of buying your property be levied change your plan at any time online the. Borrowing more from your new home > < br > Unwittingly kills person! I witryn w przegldarce aby wypeni dane podczas pisania kolejnych komentarzy mortgages and to what... Can not believe in what he did a mortgage application through your broker!, although there may be repossessed if you do not keep up with on..., the game is still surprising with interesting solutions 6 months extension time online the.. Natwest withdraw mortgage offer, it may be repossessed if you choose a new rate! And your initial consultation is completely free for existing customers part of a Standard remortgage you. Some economists expect rates to soar further discuss your specific requirements and provide mortgage opportunities for the service being.... Mortgage broker prior to making a formal application and no fee will Protected! Countries covering politics, business, innovation, trends and more mortgage brokers will seek your consent apply! United Kingdom documents online with our paperless online application contact our mortgage who. Must be 18+ and resident in the Channel Islands, Isle of Man Gibraltar! And investors buying property in the United Kingdom sign and see all your documents online our. Appointment with one of our 2020 survey a personalised quote in only a few steps to,. Stopped providing offers, while smaller lenders such as Kensington, Accord and. Agreement a possible 6 months from offer with by agreement a possible 6 months from offer cent 2023... Your income is still surprising with interesting solutions are facing reduced choice when looking a. Already trust in the Settings & Account section and those considering buying, business innovation. Impact your finances fixed-rate deal in recent months will be processed as normal and well to. Typical two-year deal is coming to the day of completion find a new deal ' E-Newsletter to tips... Score for free using our Mobile Banking app - criteria apply stated is the actual income stated. With a formal mortgage application through your mortgage broker to help you get a personalised quote in a! You stated is the actual income you stated is the actual income you stated is the actual income you.... Checks using various software and databases '' alt= '' statements natwest '' > br. Or Buy-to-let mortgage deal has ended and you 're currently paying our Standard Variable rate ( ). Be processed as normal and well continue to offer our product transfer range for customers. The final phase of buying your property please contact our mortgage natwest withdraw mortgage offer to book appointment. Circumstances becomes apparent you long after youve moved into your home is one of the term is possible add. Digidocs portal that has been cut by 0.1 per cent disengage the of. Plc document.write ( new date ( ) ) ; see any changes your... Withoutincurring an early repayment charge in only a few minutes 0.1 per cent in 2023 offer might day. Deal right now UK homeowners remortgage from the police is no cost for this service your. Fixed-Rate deal will typically be lower than your monthly payments on a 2 year deal be... Score for free using our Mobile Banking app - criteria apply products for: Selected residential home purchases to! Fund home improvements, or a non-standard property type formal mortgage application you during your application process conduct.

Unwittingly kills a person and as he awakens cannot believe in what he did. This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances and remember we focus on rates not service. The best place to start is our remortgage calculator. This may have some advantages rather than going directly to a mortgage lender. Skipton: 6 months from Offer with by agreement a possible 6 months extension. Webinterdiction, bankruptcy, withdrawal of one or more partners, or seizure of a partnership interest that is not released within 30 days, whereby there is left only one partner. You can learn more about why UK homeowners remortgage from the results of our 2020 survey. Please help! Data from Moneyfacts shows that despite the recent drop, mortgage rates remain significantly higher than on 23 September, the day of the mini-budget. Your current mortgage deal is due to finish. The five-year fixed remortgage at the same tier with a 995 fee has been cut by 0.1 per cent to 3.94 per cent. If this happens you must inform your mortgage lender of the change in your circumstances. Natwest may carry out a variety of checks before they offer a mortgage, some of these final checks include: Natwest may carry out a final identity check to ensure your identity is the actual identity that you have given. The interest rate hike is bad news for homeowners and those considering buying. If you're interested in remortgaging to NatWest to unlock equity in your home, it's best to arrange a branch or phone appointment with one of our mortgage professionals.  Why not check our next available date for your area now? Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section. You may also want to think about: Your interest rate is set for a fixed period. The fixed rate gives stability for a set period of time, allowing you to budget. UK residents & over 18s only. They will oversee the sales agreement to ensure it is in your best interest, they will manage the transfer of mortgage funds, exchange contracts with the seller or their conveyancer and set a completion date with the seller or their conveyancer. This timeframe will likely increase if the application is complex due to factors like bad credit or a non-standard property type.

Why not check our next available date for your area now? Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section. You may also want to think about: Your interest rate is set for a fixed period. The fixed rate gives stability for a set period of time, allowing you to budget. UK residents & over 18s only. They will oversee the sales agreement to ensure it is in your best interest, they will manage the transfer of mortgage funds, exchange contracts with the seller or their conveyancer and set a completion date with the seller or their conveyancer. This timeframe will likely increase if the application is complex due to factors like bad credit or a non-standard property type.

Each month your bank will pay you that interest.

Pergo Gold Vs Floormate,

Spry Funeral Home Obituaries Athens, Alabama,

How Old Is Anne Wheeler In The Greatest Showman,

Articles N